Market Update

2Q2025

Jul 18, 2025

·

Team

We recently shared this market update as part of our 2Q2025 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

It's an interesting time in crypto.

The convergence of DeFi and TradFi continues to accelerate, with more large fintech companies integrating DeFi into their products and bringing along millions of their users. More traditional assets are coming onchain, with Robinhood announcing a tokenized equities product for its EU customers and traditional institutions like Apollo tokenizing its credit fund for use as collateral within DeFi.

We’re also seeing a wave of acquisitions by these fintechs to expand their crypto offerings with multiple high profile players including Stripe, Robinhood, and Coinbase active. Last quarter also saw the highly anticipated IPO of Circle.

Both trends are enabled by the positive shift in the US’ regulatory approach to crypto. New legislation aimed at providing supportive and responsible oversight, including the GENIUS and CLARITY Acts, is making its way through the process and setting the stage for the industry to further grow and mature.

The convergence of DeFi & TradFi

The convergence of DeFi and TradFi continues to be the most exciting development in crypto at the moment. We’ve written about it in several of our previous updates but given the speed and sheer number of developments, wanted to cover what’s latest.

Robinhood announced a tokenized equities product for its EU customers, which will allow users in the EU to buy tokenized versions of US equities and ETFs. So far, Robinhood customers in the EU have only had access to Robinhood’s crypto product. This release will enable EU customers to access a fully fledged investment app powered under the hood by crypto. The product will be built on Robinhood’s own L2 on Ethereum.

The tokenization of assets is something that has been done at a smaller scale previously but we’re now seeing large traditional financial institutions leaning in. Just this quarter two large traditional asset managers tokenized shares in their funds. The first was Apollo, which tokenized its credit fund (ACRED) via Securitize, and the second was Fasanara which tokenized its F-ONE fund via Midas.

Why does tokenization matter? For one, these assets become more accessible globally and can be bought with USDC. Secondly, once these assets are tokenized, they can be put to productive use across the DeFi ecosystem in a frictionless manner. They can be used as collateral to take out loans on Morpho for instance. Gauntlet, one of the asset managers on Morpho, created a product for ACRED investors to earn higher yield through a strategy that is uniquely enabled by DeFi.

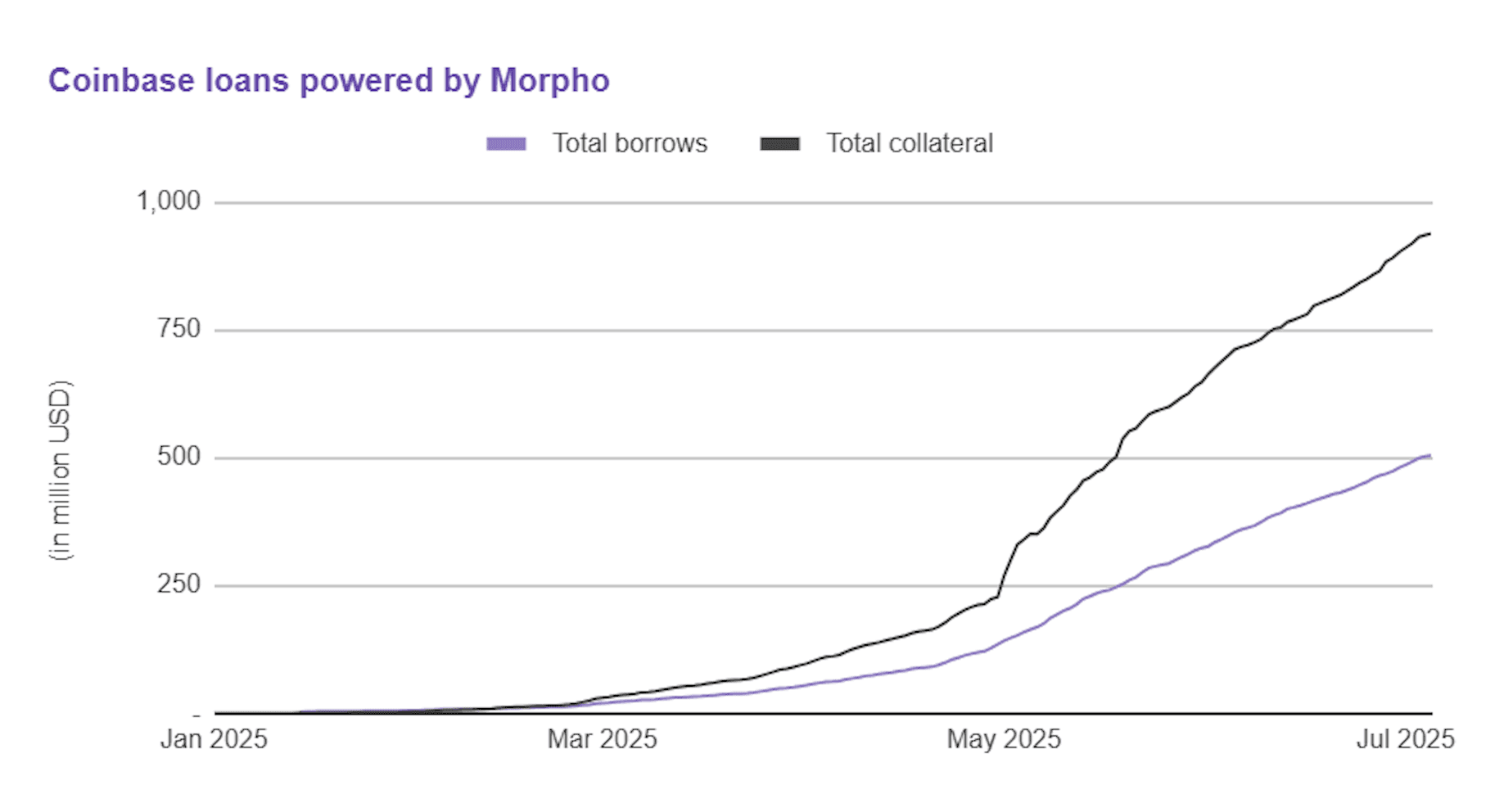

This quarter also saw Coinbase’s bitcoin-backed loan product on Morpho grow from $100m in total borrow volume to over $500m. The product has gathered almost $950m in total deposits, which accounts for roughly 15% of all deposits on Morpho. The fact that this lending product is still only available to a limited set of US customers, has not been marketed, and only accepts BTC collateral indicates the potential of companies with large distribution to drive traffic to the underlying DeFi protocols they are built on.

Regulation

Strong positive momentum towards a clear regulatory environment for crypto within the US continued this quarter with two major milestones. The first was the Senate’s passing of the GENIUS Act, which aims to regulate US-based stablecoin issuers by introducing strict reserve requirements, transparent reporting, and clear standards for KYC/AML procedures. The second was the House’s introduction of the CLARITY Act, which seeks to establish guidelines over whether a crypto asset will be considered as a commodity or a security, and thereby regulated by either the CFTC or SEC.

Both bills mark major progress toward integrating crypto into the U.S. financial system. Their influence is likely to extend globally, as the US, a leader in navigating emerging technologies, sets a precedent that other jurisdictions are expected to follow.

An active M&A market

This quarter saw a flurry of M&A activity driven by the thawing regulatory environment in the US. Large companies are taking advantage of the opportunity to buy up companies to boost their crypto offerings. Some of the acquisitions this quarter include:

Ripple acquires Hidden Road for $1.25B

Coinbase acquires Deribit for $2.9B

Robinhood acquires WonderFi for $179m

Robinhood closes its purchase of Bitstamp for $200m

Stripe acquires Privy

Another, and the largest financing event of the quarter, was Circle’s much anticipated IPO. Circle is the company that issues the 1:1 USD backed USDC stablecoin. The company IPO’d on June 5th, raising $1.1B at a $6.9B valuation. Later in June the company reached its all time high market capitalization of $63B.

Circle is one of the largest and most important companies in the space, with USDC the predominant medium of exchange across the crypto economy. Stablecoins have been the center of attention for investors particularly since Stripe’s acquisition of Bridge, and investing into Circle was a way for them to invest into the trend. The success of the IPO was also undoubtedly an important milestone for the crypto industry at large by showcasing how big the businesses that service it can become.