Market Update

3Q2025

Nov 26, 2025

·

Team

We recently shared this market update as part of our 3Q2025 update to our own investors. We’d like to share this context more broadly as it may be helpful to founders, LPs, VCs, and others elsewhere.

Public markets were choppy this quarter, but development across the ecosystem continued steadily.

This quarter was a breakout period for prediction markets with the two leading players, Polymarket and Kalshi, both securing substantial funding rounds. These platforms represent more than just a new class of financial markets attracting institutional attention, they are also emerging as powerful information markets. By leveraging market mechanisms to aggregate beliefs with skin in the game, they offer a new way to gauge the likelihood of virtually any event occurring.

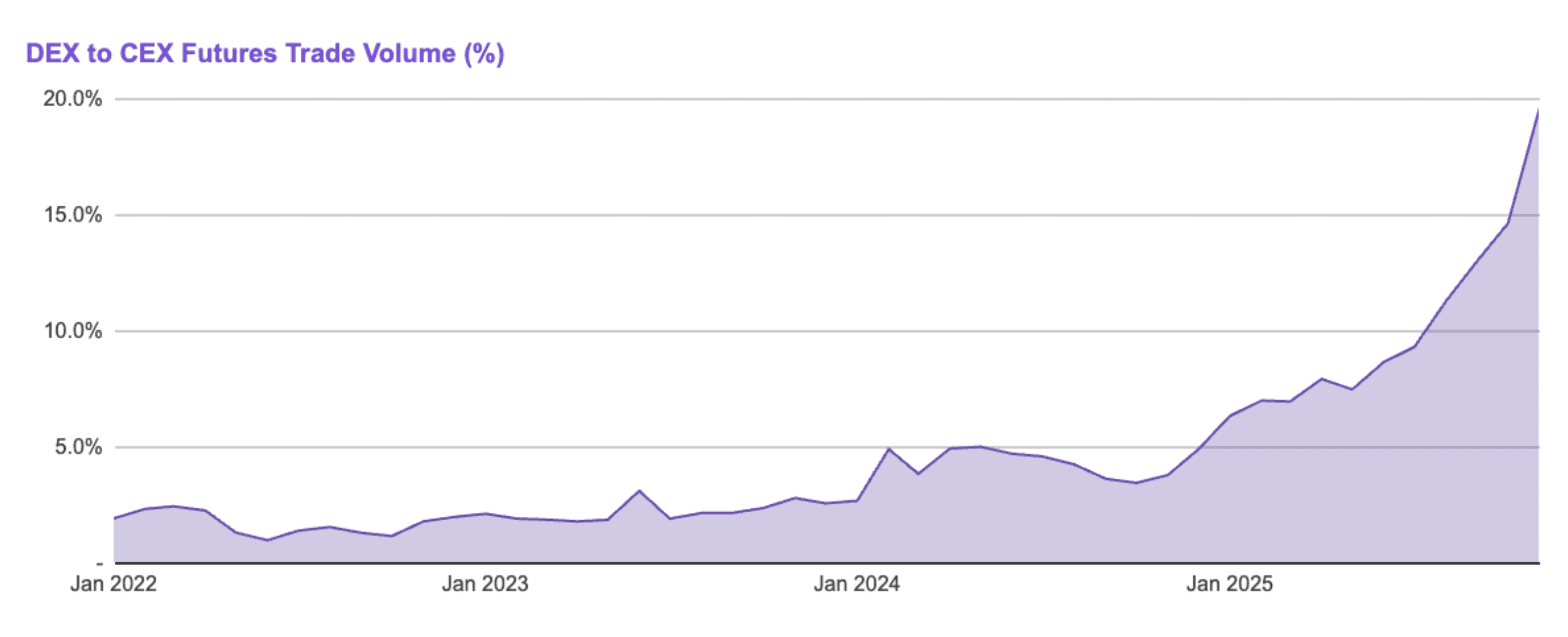

The convergence of DeFi and TradFi continues forward. One subcategory that deserves more attention within this context is the rapid rise of decentralized perpetual exchanges (perp DEXs) and the proliferation of markets they offer across both crypto-native and traditional assets. This has become one of the fastest-growing segments in DeFi, with platforms like Hyperliquid leading the charge. These decentralized venues are beginning to capture meaningful market share from their centralized counterparts such as Binance and Bybit, signaling a structural shift in how derivatives markets are being built and traded.

Finally, Q3 saw remarkable progress on the stablecoin front. The much anticipated GENIUS Act was enacted in July, establishing clarity for what would constitute as a US-compliant stablecoin. This then allowed actors from all sides of crypto to launch initiatives towards their GENIUS-compliant stablecoins, from crypto incumbents like Anchorage to traditional tech companies like Stripe and Cloudflare. With the race for stablecoins now at its fiercest moment, the last major development has been the launch of payments-dedicated blockchains by stablecoin issuers like Circle and Tether and payment processors like Stripe in their efforts to become more vertically integrated.

Prediction markets

Q3 was a breakout moment for prediction markets. Beyond their prominence as a cultural phenomenon from last year, this quarter saw the cementing of this category as a fundamentally new market that will be integrated into our daily financial lives.

Both Polymarket and Kalshi, the two leaders in the space, raised large financing rounds. Polymarket secured a $2bn investment at a $9bn valuation led by Intercontinental Exchange (ICE), the parent company of the NYSE. ICE saw this as a strategic investment allowing the firm to be the global distributor of Polymarket’s data into financial markets. Kalshi then followed by raising $300m at a $5bn valuation.

While they’re both prediction markets, they’ve taken very different paths to get to where they are today. Polymarket is fully crypto-native, built on Ethereum’s technology, and started life unregulated. It shot to prominence by offering markets for the 2024 presidential election, notably forecasting a win for Donald Trump ahead of all the prominent pollsters who were still predicting a Kamala Harris win. It was hit with a CFTC fine in 2022, forcing it to step outside of the US, but has since taken steps toward compliance, including acquiring a U.S. exchange (QCX) and now receiving a CFTC no-action letter to operate domestically. Its biggest markets continue to be in politics.

Kalshi, on the other hand, went the opposite route. It was not originally built onchain and has been regulated in the U.S. from day one, operating under CFTC approval as a designated contract market. That path wasn’t smooth sailing as they even sued the CFTC at one point (and won). Their biggest markets now are sports-related, which drive most of their recent volume.

Interestingly, both are moving in each other’s direction. Polymarket is coming onshore to service the domestic market, while Kalshi is building out its onchain offering to more easily reach a global audience.

The growing institutional interest and regulatory progress suggest that prediction markets are evolving beyond niche experiments and starting to establish themselves within the broader financial landscape. For example, major market-making firms such as Susquehanna International Group are reported to be providing liquidity on Kalshi, and there are media reports that firms like Citadel are evaluating their involvement in Polymarket.

As net new markets built onchain and openly accessible to DeFi, we’re excited for a new class of products to natively integrate and build on top of the user positions and market data from these markets.

Perp DEXs

Perp DEXs are starting to assert themselves as a core export from the DeFi world. Perpetuals are a distinctive financial instrument that first emerged in the crypto ecosystem. Whereas traditional futures contracts have a fixed expiry date, perpetual futures or “perps” allow traders to hold cash-settled positions indefinitely with no set delivery or settlement date.

They were first conceptualized in academic literature, being formalized by Robert Shiller in 1993, but only found commercial traction in crypto trading around 2016 when BitMEX launched its Bitcoin perpetual-swap product. The reason they first emerged in crypto is straightforward: the markets run 24/7, carry high volatility, and attract a user base accustomed to leverage. Perps allow traders to efficiently maintain exposure without having to roll contracts or worry about expiry, which suits a fast-moving global market that never closes.

Although the history of perpetuals in crypto started from centralized exchanges, 2025 has been the breakout year of natively onchain offerings. The reason for this rise has been two-fold: one is the geographic accessibility offered by not having to set up centralized operations in each local jurisdiction. The second is the velocity and diversity of the markets offered. Beyond just crypto-native assets, perp DEXs now offer more markets than their centralized equivalents, for example on assets like equities indices, commodities, and foreign exchange pairs.

Among the perp DEXs today, Hyperliquid is the clear leader. It recorded monthly trading volumes in the hundreds of billions of dollars, including more than $280bn in September 2025. This translates to a $1bn+ annual revenue run rate for a project operated by a core team of just 12 people, or $100m+ in revenue per employee.

Momentum across the category continues to build. The overall perp DEX sector exceeded one trillion dollars in trading volume for the first time in September, up nearly fifty percent from August. The surge was fueled by intense competition among key platforms, with Hyperliquid, Lighter, and others contributing to the record figures. Extended, our portfolio company, is also emerging as a serious contender, steadily growing its user base and trading activity.

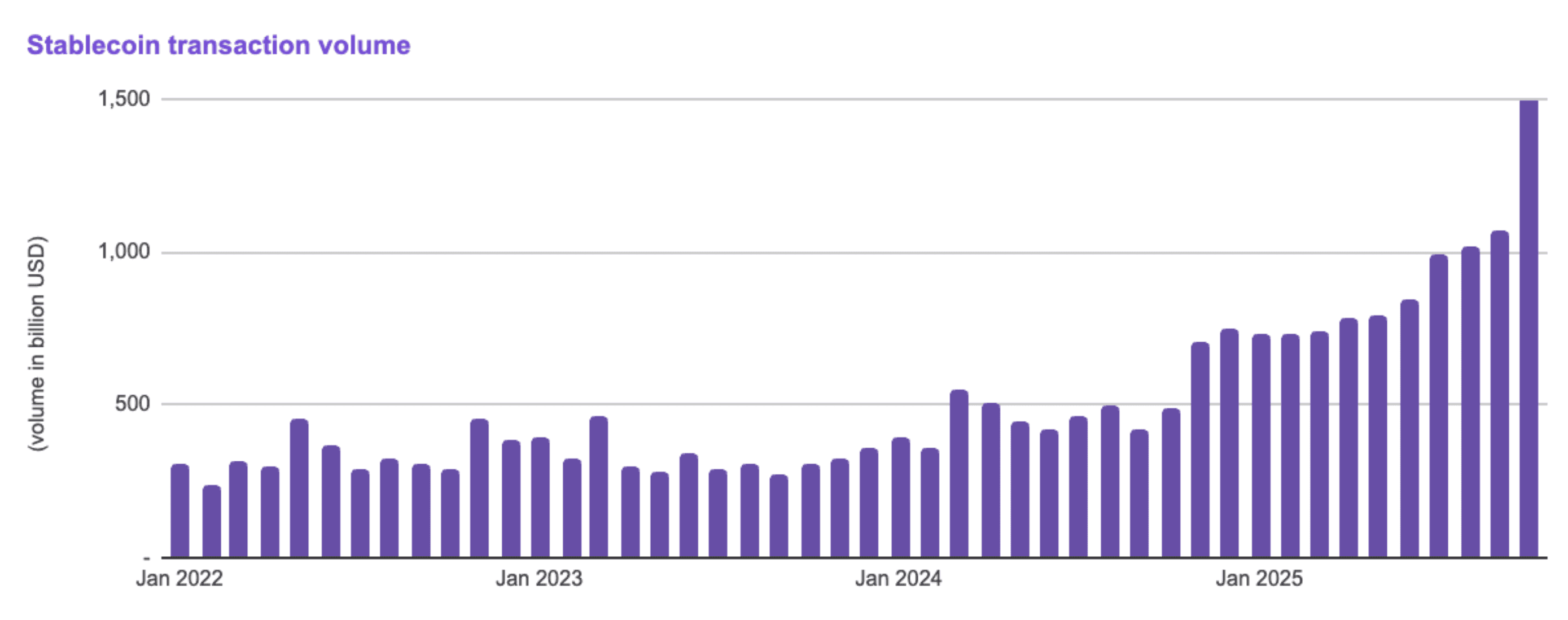

Stablecoins

Stablecoins have continued their dramatic growth this quarter, with $265bn in supply at the end of September and $1.07tn in monthly transaction volume.

The vast majority of circulating stablecoins and their transaction volume today are with Circle and Tether’s variants who together make up 97% of the circulating supply ($259bn of $265bn) and 99% of the volume ($1.06tn of $1.07tn). These assets and their activity also sit predominantly on general purpose blockchains including Ethereum, Base, Tron, and Solana.

Two major developments this quarter are set to change this dynamic. The first is the enactment of the GENIUS Act, which had previously passed the Senate in Q2 and was signed into law in July. As a refresher, this bill regulates the issuance and circulation of stablecoins by enforcing strict reserve requirements, mandating transparency, and establishing AML/KYC standards for stablecoin issuers.

While the bill largely accommodates existing issuers like Circle and Tether, what’s important about it coming into effect is setting the framework that allows other companies to become issuers of their own stablecoins. This immediately materialized in July with crypto-native player Anchorage, who already operates as a federally chartered bank, announcing their ability to issue GENIUS-compliant stablecoins on a white-label basis, starting with partners like Blackrock and Ethena. But more interesting are the traditional tech companies, like Stripe’s Bridge and Cloudflare, who also announced their plans to become compliant stablecoin issuers. The race for stablecoins, and the revenue from their underlying yield, is ultimately one of distribution and will be a natural extension for many companies who process transactions or hold user deposits.

The second major development is the increasing verticalization to own the underlying blockchain rails supporting stablecoin deposits and transfers. Q3 saw the culmination of Stripe, Circle, and Tether all establishing their own first-party blockchains dedicated to processing their own stablecoins. Stripe and Circle respectively announced Tempo and Arc, which are still in their early engineering phases and look to add more functionality around privacy and foreign exchange flows. Tether saw two affiliate projects, Plasma and Stable, launch their mainnets. Rather than relying exclusively on general purpose blockchains, all three players are seeking to create a better end-to-end product by owning the infrastructure and, in the process, capturing more of the user base and fees generated.